By David Scribner

August 26, 2011

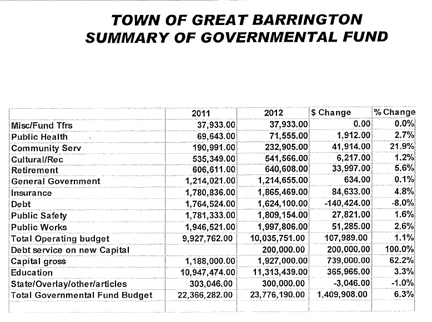

GREAT BARRINGTON – With misgivings and trepidation, the Board of Selectmen has approved a 2012 tax rate of $13.12 per $1,000 evaluation, an increase of 7.9 percent over last year.

If there is silver lining to this grin-and-bear-it annual ritual of setting the tax rate, it is the decline of property evaluations that softens the blow of a higher tax rate – at least for now, until property values start to rise again due to a more stable economy and, in five years perhaps, the introduction of commuter rail service to New York City.

The rate is based on a total taxable personal and real property valuation of $1,351,621,807, a decrease of 2.9 percent from last year.

According to Principal Assessor Christopher Lamarre, the valuation of the average Great Barrington residence slipped to $374,500, dropping by 3.2 percent. This results in a 2012 tax bill on a single family home of $4,913, an increase of 4 percent.

“The good news is that we’re one of the first towns to set our tax rate, so that we can send out tax bills on time,” observed Select Board Chair Sean Stanton. “That means everyone should start saving their pennies.”

While selectmen, at the recommendation of the Board of Assessors, adopted the single tax rate for both commercial and residential property, it was not without consideration the alternative: a split rate that is the practice in Lenox and Pittsfield.

With a split rate, Lamarre noted, commercial properties pay a higher rate, “shifting the tax burden off residential property.”

He also pointed out that of the various tax categories, only personal property valuations increased. Personal property includes utility installations like poles, and second home owners are assessed for personal property, although, as Stanton remarked, “it is easy to avoid the second home designation.”

The industrial sector declined 3.2 percent to $10,054,400, while the commercial class valuation was virtually flat.

Nevertheless, the selectmen retained the single rate tax structure by a unanimous vote.