Thanks to the folks at United for A Fair Economy (UFE), we now have a pretty good idea what Robin Hood might do with the wealth of the richest 400 families in America.

Turns out they’re not really rich, they’re really, really rich. To the tune of 1.73 trillion dollars. Trillion.

And it turns out that 1.73 trillion bucks has some serious purchasing power.

Here’s the way UFE recently broke it down for us:

-

The richest 400 households can pay off every student loan for every single student in the entire United States.

The richest 400 could pay your rent, and the rent of every renter for three years in the U.S.

The richest 400 could pay the mortgages of every house in the whole country for 14 full months.

The richest 400 households can buy every single house that was foreclosed on in 2007 and 2008.

The richest 400 households could pay the annual salaries of 19 million families for one year.

The richest 400 can pay off all credit card debt for every single person in the entire United States.

The richest 400 households can afford to give a $10,000 bonus to every single worker in the entire country.

The richest 400 can afford to buy a new car for every family in the United States.

The richest 400 can pay for 3½ years worth of gas for every driver in the country.

The richest 400 households can afford to triple the number of teachers in the United States, then give every single one a $30,000 raise.

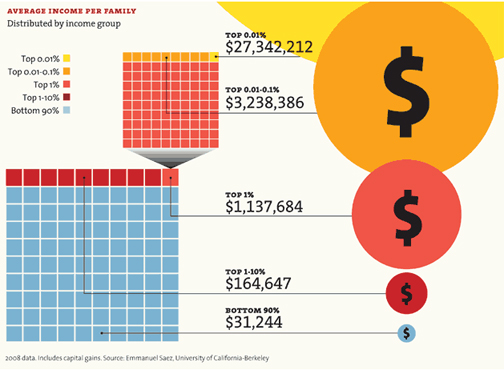

Mother Jones offers another way to look at the growing gap between the richest and poorest of Americans. They assembled a group of charts:

A huge share of the nation’s economic growth over the past 30 years has gone to the top one-hundredth of one percent, who now make an average of $27 million per household. The average income for the bottom 90 percent of us? $31,244.

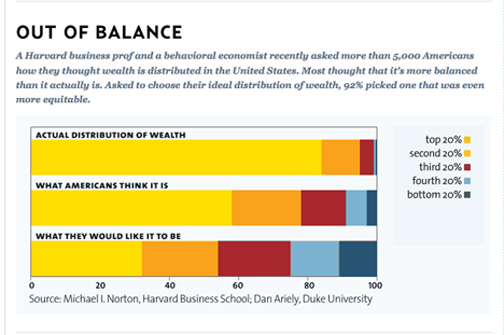

A Harvard business prof and a behavioral economist recently asked more than 5,000 Americans how they thought wealth is distributed in the United States. Most thought that it’s more balanced than it actually is. Asked to choose their ideal distribution of wealth, 92% picked one that was even more equitable.

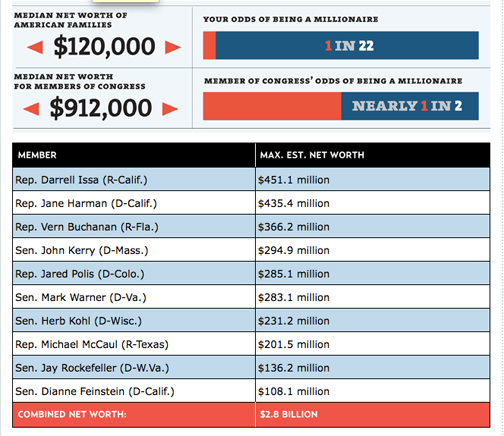

Why Washington is closer to Wall Street than Main Street.

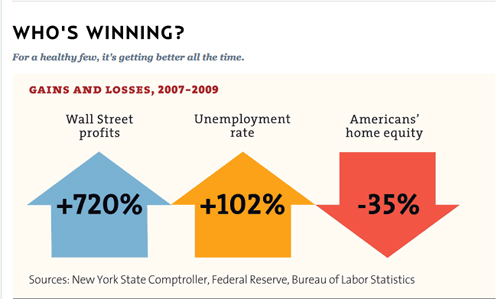

Anyway, if you’ve having trouble trying to figure out who’s been winning and who’s been losing the money war, Mother Jones can help: